For additional guidance on accurately reporting your functional expenses, reach out to your local Blue & Co. advisor today. Organizations should have an understanding of their methodology for allocating expenses and a process in place for the underlying calculations for those allocations. If a specific methodology is not in place and underlying calculations to support allocations are not maintained, implementation of these processes should be considered. Nonprofits must learn how to record functional expenses correctly to ensure compliance with federal regulations. Expenses that are directly related to specific gross revenues may be displayed sequentially with the related revenues. For example, gross revenues from special events less the direct costs related to those events, followed by a subtotal, may be reported in Accounting for Churches a statement of activities.

5.2 Analysis of expenses by nature and function

Expenses such as payroll costs, depreciation, and rent are typically attributable to multiple functional expense categories. Common benchmarks for calculating allocation across different categories are estimates of staff’s time and effort for payroll costs and square footage for occupancy costs. Costs that can be readily identified as pertaining to a specific category are charged directly to that function. For example, if an organization formed for the purpose of providing financial assistance to students disburses a scholarship, that full amount would be recorded under program services. Many expenses incurred by organizations, however, income statement are not so straightforward. The IRS requires that you report both functional and natural expenses on your Form 990.

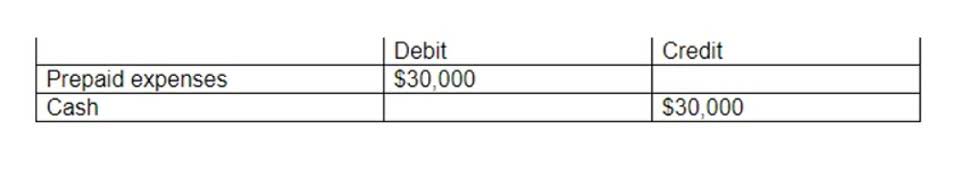

Statement of Cashflows:

(“Teplitzky”), a Woodbridge, CT-based accounting, consulting and statement of functional expenses tax firm specializing in the Healthcare industry. We highlighted the column headings for learning purposes, showing expenses by function. In the first column, we have highlighted the words as they reflect the essence or expenses. Dugan + Lopatka, CPAs can modernize, streamline and augment your financial management. Our experienced CPAs deliver everything from accurate bookkeeping and timely reports to in-depth guidance and strategic planning.

Focused Programs

- When handling your organization’s finances, it’s important to have a thorough understanding of all aspects of your organization’s income and expenses.

- Topic 958 not only requires disclosure of expenses by natural and functional classification, but also requires disclosure of the allocation methods in the notes to the financial statements.

- Beyond compliance, there are other reasons why organizations should care about tracking functional expenses.

- It also contains non-profit net assets, which display the organization’s total worth, equivalent to the business’s equity.

- Natural expenditure here tells us about where the money went in respect to what in return.

- Looking at the area, the organization sees how the total square footage of the office space compares to the number of offices occupied by specific departments.

- The timesheet helps in sorting different needs and in deeply analyzing the allocation of the funds.

Examples include new funding streams or debt, new programs, personnel changes, changes to staffing roles and responsibilities, changes to rental space, etc. Looking at the number of people working on each program at the nonprofit business and the expenses they accrue, one can determine each individual employee’s and program’s expenses. This allocation method is only effective for nonprofits with a small number of employees, often that does not exceed more than a thousand employees.

- Dugan + Lopatka, CPAs can modernize, streamline and augment your financial management.

- If the allocations are far out of line from the organization’s peers, it could be an indication that the method for allocating functional expenses should be revisited.

- Many donors will review organizations’ Form 990s as part of deciding which organization they wish to donate.

- Our nonprofit accountants have had success in providing complete and accurate statements of functional expenses for nonprofit businesses.

- Form 990 includes a separate page dedicated solely to the allocation of functional expenses — yet another reason why presenting a separate statement of functional expenses in the financial statements is convenient and efficient.

If you’re a nonprofit interested in improving your expense categorization and organization, contact our sales team to learn more. This category works by counting the number of people working on a project and the expenses each person makes. However, this approach only works for a smaller organization with less employees or workers. Counting expenses on per person basis in an organization with 1000+ workers can be hectic and the calculation can be flawed. In some cases, the cost spent for fundraising has to be counted under the program account.

YOUR COMMENT